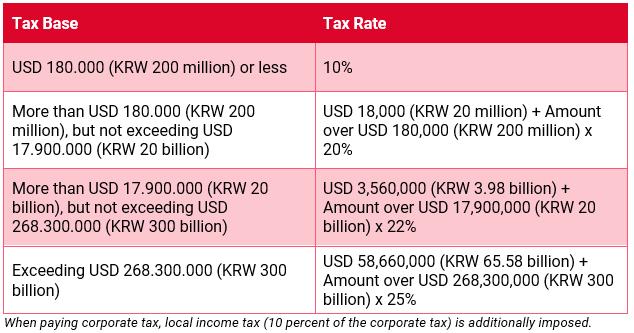

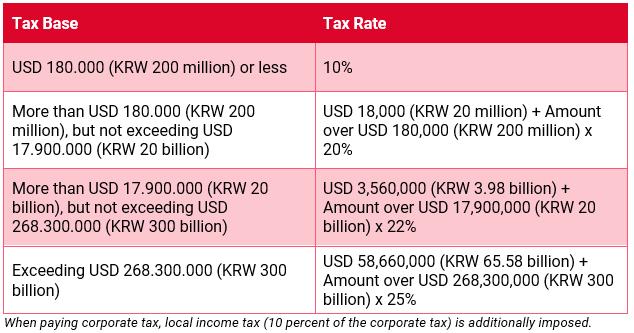

- Corporate tax

Corporate tax is an income tax imposed on corporations. Incorporated associations and foundations, including for-profit and non-profit corporations, are taxed like general corporations.

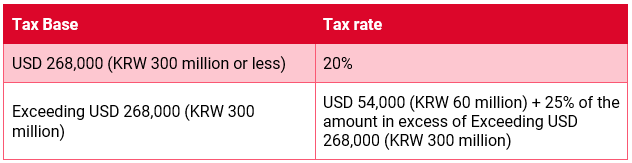

- Value-Added Tax

Value Added Tax (VAT) is a tax that is reported and paid for added value acquired in the process of providing goods and services and importing goods.

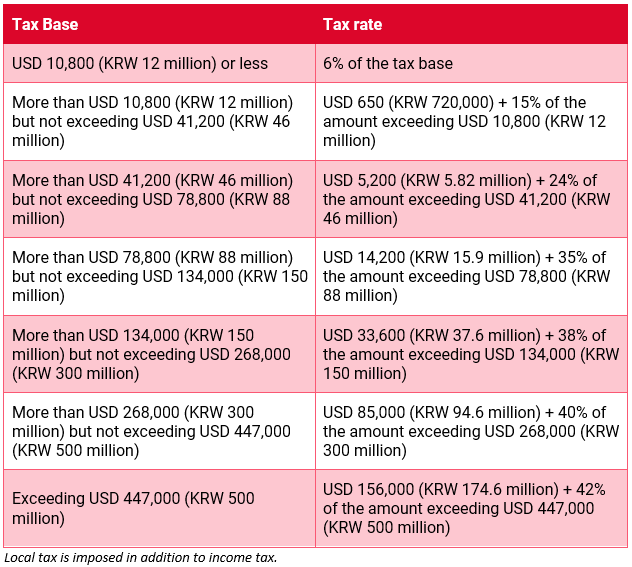

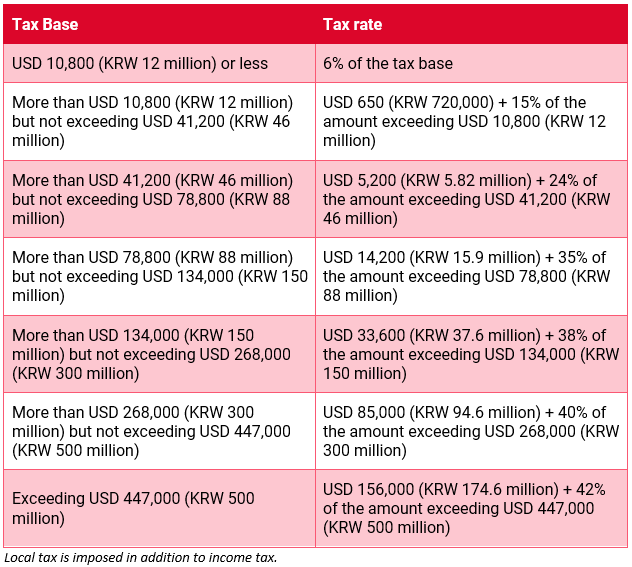

- Wage and Salary Income Tax (for workers)

Wage & salary income tax is a tax levied on the price of providing and receiving work. Wage & salary income, regardless of its name and form, includes goods and stocks in addition to cash.

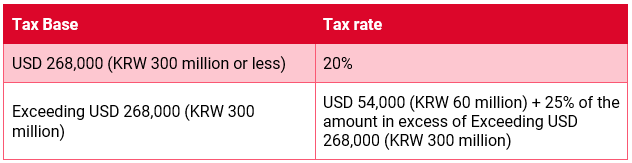

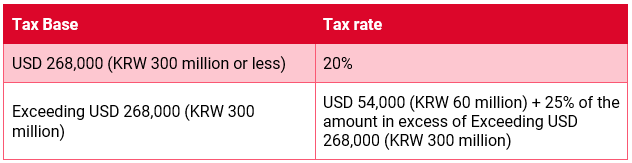

- Capital Gains Tax (stocks, etc.)

Capital gains tax is levied when an asset is transferred to an entity for payment through sale, exchange, or in-kind contribution to a corporation.

Tax Rate

- Stocks, etc. Transferred by Majority Shareholders:

- Stocks, etc. of a corporation, excluding small and medium size enterprises, held for less than a year: 30% of the tax base;

- stocks, etc. that do not fall under the above:

- Stocks, etc. Transferred by a Person other than the Majority Shareholder:

- Stocks, etc., of small and medium-size enterprises: 10% of the tax base;

- Stocks, etc. that do not fall under the above: 20% of the tax base.

- Securities Transaction Tax

Securities transaction tax refers to tax imposed on the transfer value of share certificates, etc. where the ownership of share certificates or shares is transferred for value due to a contract or legal causes.

Tax Rate

The securities transaction tax rate (unlisted stocks, etc.) is 0.45 percent (from Apr. 1st 2020).

Disclaimer: illustrative; percentages based on latest applicable regulation at the time of publishing. Information provides does not substitute professional advice from our consultants. Exchange rate used for USD ~1,118.