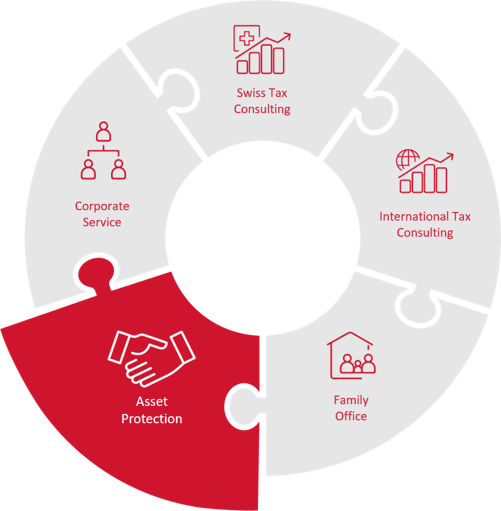

Our competences

Wealth protection and succession planning requirements make it increasingly necessary to define strategies and identify legal instruments suitable for the pursuit of the objectives set out during planning.

The aim is twofold: on the one hand, to preserve current and future assets; on the other, to organise the generational changeover, defining the governance of families and businesses with rules that can regulate their relations and avoid possible future disputes.

Asset protection, as a preventive form of segregation of assets, or part of them, is not only a cultural issue (which assets are to be protected; which assets are to be passed on to future generations). It often requires a factual analysis and a specific assessment of the legal and economic assumptions underlying the need to identify appropriate asset protection solutions.

Fidinam & Partners, thanks to its acquired experience and expertise, is able to follow and create value at all stages of the process; with a dynamic and interdisciplinary approach, the needs and expectations of the client are analysed and evaluated with professionalism in order to identify and develop specific solutions aimed at enhancing and consolidating the assets, where protection and safeguard are essential elements.

Trusts, foundations, family wealth management companies and other similar legal instruments, allow the pursuit and satisfaction of the most diverse needs of asset protection: typically institutions of Anglo-Saxon Common Law, today they are recognised also in the countries of Civil Law; in many other cases they can be useful in order to pursue certain purposes of solidarity, cultural or, more generally, of social utility. Various levels of asset segregation offering various levels of protection. Our presence in various jurisdictions (both Civil and Common Law) as well as our many years of professional experience enable us to identify and select the distinctive elements (legal, economic or simply factual) on which to build asset protection.

The valorisation and consolidation of assets requires careful management of resources and processes: asset protection is a project and not a product, which is why it is important to be able to guarantee the coordination of each phase, from the implementation of the project to the definition of governance and management processes. With two trustee companies (we are present in New Zealand and Hong Kong) we can guarantee management in line with the objectives (defined in advance) and the strategies for the safeguard and protection of assets with a long-term vision. We also provide accounting services, preparation of financial statements, tax returns and tax compliance in accordance with the relevant legal system and international standards (i.e. automatic exchange of information under the Common Reporting Standard -CRS- and the Foreign Account Tax Compliance Act -FATCA-).

The generational changeover: just a question of continuity? The analysis of the composition of the entire family and business assets, the assessment of the conditions that could put their integrity at risk, the need to ensure the continuity of the business, the need to protect certain family members (e.g. minor children) are fundamental elements in the process of defining the strategy to safeguard and protect the assets. In this sense, succession is not always an automatic process. Instruments such as a will, a deed of gift, a life insurance policy, a family pact and the definition of family/corporate governance complement the range of possible asset protection solutions. With our international experience, our legal and tax expertise, and our network, we represent a fundamental point of reference to whom you can turn for a conscious and programmatic approach to planning the generational transition.

Since 1960, the Fidinam Group has been protecting assets on behalf of private families in several jurisdictions. Discover our dedicated brochure.

No Data Found

All content © . All Rights Reserved.