on regulatory developments

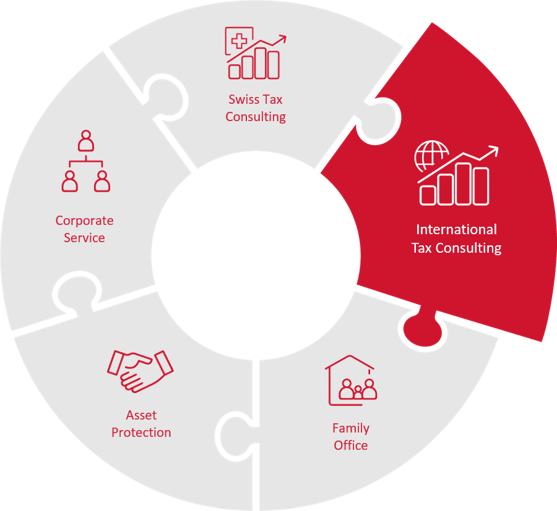

Thanks to the expertise acquired since 1960 and to the collaboration with an extensive network of foreign professionals, we are able to support the needs of entrepreneurs, companies and multinational groups that are confronted with international tax issues and that require knowledge of multiple tax systems, European Directives and international regulations.

Our team can assist clients in the most efficient and effective way both in the study and/or implementation phase of a new project and in the reorganisation of existing businesses, highlighting tax issues and identifying possible solutions.

Multinational group reorganisations, cross-border mergers and demergers, transfer of corporate headquarters and international M&A transactions can have significant tax implications in the different countries involved. Careful advance analysis can help to avoid or minimise the tax issues associated with these extraordinary transactions by identifying the most efficient ways to implement them.

The existence of many different types of investment funds (in terms of legal form, tax treatment, regulation, etc.), the presence of various European and non-European financial centres that are particularly convenient for the location of an investment fund, make it essential to carry out a preliminary analysis which, taking into account the objectives and needs of promoters and investors, allows the identification of the best type of fund and the optimisation of setting-up and administration costs.

In the context of international relocation of entrepreneurs, tax optimisation requirements often take second place to family needs. An in-depth knowledge of different European and non-European jurisdictions and the possibility to assist clients locally with professional and trustworthy people, even after their relocation, are indispensable factors for planning everything correctly and ensuring peace of mind in such an important life choice.

The increasing complexity of the administrative requirements introduced by the FATCA regulations, the Common Reporting Standard, cross-border arrangements (i.e. the E.U. Directive DAC6) and the possible consequences and penalties in the event of errors and/or omissions, require continuous updating and in-depth knowledge of the various international regulations that govern the exchange of information in tax matters.

No Data Found

All content © . All Rights Reserved.